Consumer Credit Law

Federal Debt Collection Practices Act, Federal Credit Reporting Act, Truth In Lending/ Regulation Z

Breach of Warranty/ Lemon Law, False or Misleading Advertising

If you have a reason to believe that:

- You have been exposed to an unscrupulous oppressive communication from a debt collector;

- You did not receive a notice before a creditor repossessed your home or your vehicle;

- You incurred undue damage to your credit as a result of unscrupulous lending or a bill you did not in fact owe;

- You borrowed under terms that were not fully disclosed to you before you signed the note;

- Credit bureaus did not fully or properly investigate the veracity of a disputed item on your credit report;

- You received a cold call, or a voice mail from a business entity you are unaffiliated with soliciting goods or services;

- Goods you purchased for personal and household use did not comport to the warranty;

- Item, good or a service you received was materially different than one advertised;

- You were sued by a debt collector who obtained a judgment and attached your personal bank account;

Robo-calls or Unsolicited Txt Messages

The Telephone Consumer Protection Act (“TCPA”)and other similar laws regulate unwanted telemarketing calls, junk/unsolicited texts to cell phones that occur at recipient’s cost. The Federal (“TCPA”) and other similar laws outlaw conduct where an advertiser resorts to making calls using automatic telephone dialing systems or prerecorded voice systems to cell phones or to residential lines where there is no consent of the recipients. The TCPA allows private actions by persons subjected to the prohibited conduct to recover up to $500 per violation (usually per call or per txt message/fax), or even up to $1500 if violation was willful.

Predatory Lending

The federal Truth in Lending Act (“TILA”) protects consumers from overcharges and other undisclosed “costs of credit”. Other federal lending laws such as the Equal Credit Opportunity Act (“ECOA”), which protects against credit discrimination, and the Real Estate Settlement Procedures Act (“RESPA”), which prevents kickbacks and bait-and-switch lending, exist to help borrowers in the often complex area of loans and consumer lending. Several state laws also provide protection for borrowers.

Please call for a free consultation, you may have a viable case in which case the wrongdoer will be obligated to pay for your reasonable attorney’s fees separate and apart from any amount owed to you for any successful action the firm would bring to vindicate your rights, including an out of court settlement.

Banking Law

OVEDRAFT FEES

Unscrupulous Overdraft and other bank fees in contravention to accountholder agreement and other applicable law.

EFTA (Electronic Funds Transfer Act)

If you have a reason to believe that your bank:

- Charged your account with excessive overdraft fees;

- Manipulated your ATM and debit/credit transactions to maximize the overdraft fees;

- Refused to refund your account fully for charges you did not authorize;

- Otherwise failed to honor their contractual or statutory obligations to you;

Please call for a free consultation. You may have a viable legal cause of action your bank, in which case they will have to pay for the full amount of your attorneys fees, separate and apart from any amount they may be obligated to pay you in satisfaction of your claim.

FRAUD / MISREPRESENTATION, BREACH OF FIDUCIARY DUTY

(Including misconduct by Power of Attorney)

Guardian of the Estate

If you have a reason to believe that:

- Your Power Of Attorney misused of his/her designation to convert or commingle your funds and assets to his/her own personal use or benefit;

- Your family member has been declared incapacitated and appointed a guardian, who charges excessive fees to the estate of the incapacitated person;

- Your home repair contractor charged excessive fees to do the repairs or never did the exact work promised under contract;

- Your bank mishandled the processing of your power of attorney authorization;

- Your bank allowed your account to be accessed in fraudulent fashion by an unauthorized person;

…and your pleas for a full refund or correction of the problem have been ignored, please call for a free consultation. You may have a viable case, in which case they wrongdoer may have to pay for your attorney’s fees separate and apart from an amount you would recover.

Insurance Bad Faith

Generally insurance is a contractual relationship by which one party promises to pay for the other party’s loss that may or may not occur, up to a certain amount (policy limit), in exchange for a series of preceding payments known as the premium. All is well and dandy if the Insurer fulfills their obligation to cover the loss. However unfortunately more and more often the Insurers renege when it comes time to pay, to such extent that Commonwealth of Pennsylvania has long ago enacted a statute 42 Pa.C.S.A. § 8371, creating a separate cause of action design to remedy the injustice thereby created. Upon showing that certain culpability thresholds are met, the statute allows for a monetary punishment from the Insurer to the benefit of the insured. Mr. Filipovic currently handles select cases of bad faith in insurance on the behalf of maltreated insureds.

Please call for a free consultation.

Unemployment Law

Mr. Filipovic successfully represents clients before the Pennsylvania Unemployment Commission at the UC Appeals level.

Even if your employer did not report your income to Pennsylvania Unemployment Commission and failed to pay unemployment insurance, you still may qualify for unemployment benefits.

If you resigned from your job under circumstances where your employer made it unduly difficult for you to remain employed, you might have been constructively terminated and you may qualify for unemployment benefits.

Please call for a free consultation.

American’s with Disability, Family Medical Leave of Absence

Congress remanded the Americans with Disabilities Act (ADA), effective January 1st, 2009 in ways that largely favor consumers, workers and the disabled, explicitly rejecting Supreme Court holdings in Sutton v. United Air Lines, Inc., 527 U.S. 471 (1999). In essence, the new ADA allows for broader coverage of individuals by providing and expanding out a clear yet non exhaustive list of what constitutes a “major life activity”. Walking, breathing, lifting, eating are included, but so are cognitive activities like concentrating, thinking, caring for oneself, sleeping, socializing, etc. Secondly, under the old ADA, if a person could ameliorate their disability with a use of a corrective measure (prescription glasses, a walker, sleeping medication), it was person’s condition after the use of corrective measures that was used to determine if person was disabled. Under the new ADA it is the condition of a person before any corrective measures are used that is used to determine if they are in fact disabled within the meaning under ADA. For example the person could be hard of hearing but hear well with the use of a hearing device. Under the new ADA that person would likely meet the criteria.

If a person is found to be disabled under the meaning of the ADA, then generally employers, landlords, public institutions are required to make reasonable accommodations to help those individuals.

Pharmacy Malpractice

Mr. Filipovic grew up in a family of two physicians with over 60 years of combined experience in a large hospital and triage setting. Such exposure resulted in more than a basic understanding and familiarity with medical terminology and physician-patient interplay in various stages of treatment and caregiving process. Mr. Filipovic also spent 6 years as a Financial Exploitation Specialist for the Older Adult Protective Services, becoming very familiar with geriatric and issues specific to the aging population.

Through the network of familial medical contacts he is able to obtain qualified expert opinion and initial case evaluations in early stage, in cases where another firm’s cost may be deemed prohibitively expensive.

Please call for a free consultation. The firm handles Pharmacy errors and misfiled prescription matters.

Personal Injury

Mr. Filipovic handles numerous personal injury cases stemming from premises liability, pharmacy malpractice as well as civil assault and battery implicated via responded superior doctrine. He litigates on the behalf of numerous injured clients against companies such as Rite Aid, Wal-Mart, Four Corners Management, and will not hesitate but embrace taking the case all the way to a jury trial if that rout is in the best interest of the client. Please call for a free consultation.

Immigration

Mr. Filipovic is a first generation immigrant himself, having held various Visas and statuses for over a decade. He has encountered a large number of various difficult immigration situations.

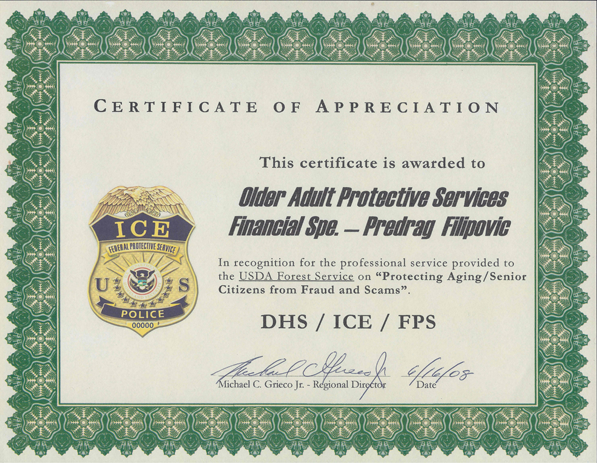

For his services in providing lectures on Identity Theft and other forms of financial exploitation to the employees of the Federal government (Customs Enforcement, Health and Human Services, US Forest service, and U.S. Treasury), Mr. Filipovic received an honorary certificate of appreciation from the Department of Homeland Security, Immigration Customs Enforcement (ICE) and Federal Protective Services.

Please call for a free initial telephone consultation.